From familiar comfort foods to new healthy options – the pandemic has paved the way for a shift in grocery shopping trends and eating habits over a very challenging 12-18 months.

We already know that the food and beverage manufacturing industry has seen and adapted to huge change, with America really sinking its teeth into food innovation as a result of the Covid-19 impact.

But despite lockdowns being lifted and panic buying a seemingly thing of the past – groceries remain a big spend for many households.

Did you know that (according to Move.org) the average cost of groceries in America is $355.50 a month per person? Though this number varies depending on location.

In October 2021, grocery prices were 5.4% higher than a year prior, according to the latest consumer price index.

But how have grocery shopping habits – either in-store or online – changed in 2021 and what have we been spending our dollars on?

Let’s take a look ….

Back in January, after we closed the doors on one uncertain year and opened them on another, industry experts put together a series of trends that they believed would shape the grocery industry in 2021.

The US faced uncertainty when it came to predicting how consumers would respond once their communities, offices and schools re-opened. Would they return to dining inside restaurants, or continue with the growing trend of cooking and experimenting in the culinary world at home?

The industry offered much attention and gave serious thought not only to the manufacturing of food and beverages but the service delivery and fulfilment of the process to the consumer.

It was suggested that customers who cooked during the pandemic would be likely to continue to explore at-home culinary experiences, even as people returned to bars and restaurants.

But as the new year approached, retailers were advised to invest in innovative merchandising and other offerings to keep shoppers interested.

E-commerce and customer loyalty usually go hand in hand – and many retailers began to add extra value to their offerings.

For example, Kroger launched an artificial intelligence-based digital tool that suggests recipes based on tweeted photos of food items, while Hy-Vee, H-E-B, Schnuck Markets and many others added fresh meals, including restaurant selections, to online ordering.

In-store also, some retailers have added new contactless services like smoothie making machines and salad robots.

All the above show that consumers really turned their attention to more healthy eating options as the year progressed.

There is a suggestion among industry analysts that the longer consumers are exposed to new habits as a result of the virus still being in circulation – the more permanent the changes will become.

Changes in homes and office spaces have affected consumption. The less time people spend in the workplace, the less cash they will spend on lunch.

Cyrille Filott, global strategist of consumer food, sums it up perfectly: “This is an important trend because it changes consumption,” he explained. “Twenty per cent of the location of lunch occasions will change, and the location will shift from business areas to closer to home.”

Purchase patterns are also changing. Health and wellness was the biggest trend before the pandemic, and it still has its place. But during the first six months of the pandemic last year, there was a shift toward comfort foods and premium products.

With a renewed interest in cooking, consumers tended to trade up in product quality and splurge on brands.

Here’s a really insightful read into consumer trends with evidence to suggest why pandemic-prompted changes could be here to stay.

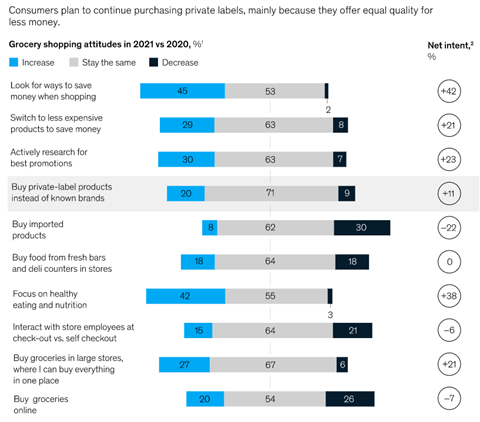

Affordability and quality have remained important for US consumers, alongside a focus on healthy eating and nutrition as well as in-store shopping experiences (to include the choice/selection of groceries available, cleanliness of the story and interaction with staff.)

Have a look at this infographic from McKinsey & Company, giving a snapshot of consumer habits.

Despite the many challenges, the food and beverage manufacturing industry has been buoyant in many states.

Let’s take North America for example. We have learned that as consumers shifted to living, working, and learning at home – a grocery industry that has traditionally seen growth of 1-2 % a year grew by approximately 12% in 2020, offsetting significant reductions in food away from home.

Research released from Supermarket News shows that reaching nearly $20 billion in sales, every area within deli increased sales compared with 2020 and 2019 during the first half of this year, according to IRI data. The largest year-on-year growth was achieved by deli-prepared with a 14.7% increase over the same six-month period last year.

As Americans have been re-introduced to the social gatherings and celebrations that were cancelled last year — most supermarkets have opened up their fresh bakery departments fully again, and that means plenty of cakes, doughnuts, breads and other fresh-baked goods available for consumers.

While sales for fresh-baked goods are up only 2.6% from a year ago, according to NielsenIQ, any gain is cause to celebrate after last year. The all-important cake category is up 6.7% year over year, a further signal of a return to normality.

For the 52 weeks ending May 29, all meat sales were up 5.6% year over year, with most of those gains in beef (up 8.5%) and chicken (up 4%). The numbers are more than respectable given the high bar set in 2020 and negated much of the worry that retailers were feeling about the possible impact of restaurant openings and home cooking fatigue on the meat category.

Meanwhile, consumer research giants Attest carried out their own study into the habits of American grocery shoppers – and here we share some of the findings with you.

A recent report from New York (CNN Business) suggests that inflation costs have hit a 30-year high in America, the knock-on effect of which is rising costs at the grocery store.

In conclusion, while the food and beverage manufacturing sector has been dealt its fair share of challenges across all sections, including recruitment – US consumers have regained their appetite for eating out, are choosing to shop smartly both in-store and online and the industry itself is adapting to a number of changes in habit alongside catering for a gradual return to normal – having learned some lessons along the way.

I started The Sterling Choice with Gareth Whyatt back in August 2013. We’ve always remained true to ourselves and what it is we’re trying to achieve – A great company with great peo...